At Accountix Solutions, we’ve seen firsthand what most business owners struggle with: financial systems that were built to “work” but never built to work well. After supporting hundreds of organizations across industries, one truth stands out—clarity and control don’t come from adding more tools; they come from designing smarter financial workflows from the ground up, just like understanding the three Cs of credit can help businesses manage their financial health more effectively.

That’s why we approach accounting differently. Instead of handing you generic software or one-size-fits-all advice, we analyze how your business actually operates—your processes, your people, your bottlenecks—and build a practical financial system that finally supports the way you work. From untangling years of bookkeeping to stabilizing payroll operations to implementing repeatable, data-driven reporting, our team brings real-world experience shaped by thousands of hours inside real businesses, not theories.

With Accountix Solutions, you’re not just getting accounting support—you’re getting a partner who has walked your path, spotted the patterns, and built solutions that eliminate complexity, reduce risk, and give you decision-ready numbers you can trust.

Quick Answers

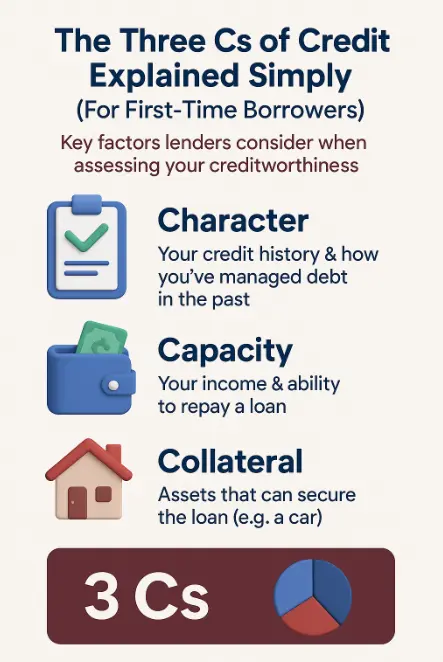

The Three Cs of Credit Explained Simply (For First-Time Borrowers)

The Three Cs—Character, Capital, and Capacity—are the core factors lenders use to understand your financial reliability, which is why outsourced accounting can play a crucial role in ensuring your business’s financials align with these key criteria.

Character: Your payment habits and account history.

Capital: Your savings and financial cushion.

Capacity: Your income and ability to handle new payments.

Top Takeaways

Know the Three Cs: Character, Capital, and Capacity guide every lending decision.

Build strong habits: Pay on time, keep balances low, and save consistently.

Predictability wins: Lenders value steady financial behavior over a perfect score.

Take proactive steps: Review credit reports, lower DTI, and use starter credit tools.

Stay consistent: Small steps create long-term financial confidence.

Accountix Solutions is a modern financial operations partner built for businesses that want clarity, accuracy, and systems they can rely on. Our team specializes in simplifying the back office—cleaning up financial data, streamlining payroll, improving day-to-day bookkeeping, and providing expert accounting services that implement efficient, technology-driven workflows to keep your financial foundation strong.

What sets us apart is our systems-first approach. Instead of reacting to problems, we proactively design processes that prevent them. After working closely with organizations of all sizes, we’ve learned that financial success rarely comes from using “more tools”—it comes from aligning the right people, processes, and platforms so information flows cleanly and decisions are backed by trustworthy numbers.

Whether you need support stabilizing your books, improving compliance, or optimizing your payroll and reporting, Accountix Solutions brings hands-on experience and practical insight to every engagement. Our mission is simple: give you the financial visibility and confidence you need to run your business more efficiently, make smarter decisions, and scale with less stress.

If you’d like, I can expand this into service-specific sections (Payroll, Bookkeeping, Cleanup, Process Optimization) or tailor it to a specific industry.

“After years of stepping into broken financial systems, we’ve learned that accuracy isn’t the result of more software—it’s the result of better processes. When you fix the workflow, everything else starts to work.”

Essential Resources: Trusted Guides to Help You Understand the Three Cs of Credit

When you're learning how lenders assess creditworthiness, having the right resources matters. At Accountix Solutions, we’ve seen firsthand how foundational financial knowledge, including professional accounting practices, can transform a borrower’s confidence. These seven resources offer clear, reliable guidance to help you understand the Three Cs of Credit—Character, Capacity, and Capital—so you can make smarter borrowing decisions from day one.

1. CFPB: Understand Your Credit Score — Get Clarity on What Actually Shapes Your Score

A dependable overview from the Consumer Financial Protection Bureau that breaks down the core factors influencing your score. Ideal for first-time borrowers who want a clean, unbiased starting point.

2. CFPB: Credit Reports & Scores — See Your Credit The Way Lenders See It

This guide shows you how to access your reports, understand the data inside, and protect your rights. It’s a must-read for anyone preparing to demonstrate “Character” to a lender.

Source: https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

3. FDIC: Credit Reports — Understand How Your History Impacts Future Borrowing

The FDIC offers a straightforward explanation of what goes into a credit report and how financial institutions use it in their decision-making process—knowledge every new borrower should have.

Source: https://www.fdic.gov/consumer-resource-center/credit-reports

4. NFCC: Credit Report & Score Guidance — Access Professional Support When You Need It

For borrowers who want more personalized clarity, the NFCC connects you with certified credit counselors who can walk you through your report and help you plan next steps.

Source: https://www.nfcc.org/resources/credit-report-score/

5. myFICO Credit Education — Learn the Scoring System Lenders Rely on Most

myFICO breaks down the most widely used credit scoring model, giving you a clear understanding of how lenders assess your “Capacity” to repay.

Source: https://www.myfico.com/credit-education/default

6. NerdWallet: How to Read a Credit Report — Decode Your Report Without Guesswork

This step-by-step guide makes it easy to interpret each line in your credit report, identify errors, and understand how each entry affects your credit health and borrowing power.

Source: https://www.nerdwallet.com/finance/learn/read-credit-report

7. LiveWell: The Three Cs of Credit Explained — See How Lenders Evaluate Borrowers

A simple, beginner-friendly breakdown of Character, Capacity, and Capital—helping you understand exactly what lenders look for and how you can strengthen each area.

Source: https://livewell.com/finance/what-are-the-three-cs-of-credit/

Supporting Statistics (Scannable Summary)

1) 5.6 million U.S. households are unbanked (2023)

Source: FDIC National Survey

4.2% of households have no bank account.

We often see this firsthand—no bank account means no clean financial trail.

Establishing basic banking is usually the first system we help clients build.

Source: https://www.fdic.gov/household-survey

2) 26 million Americans are “credit invisible”

These individuals have no credit history with major bureaus.

Without a score, lenders have almost nothing to evaluate.

We help clients create simple, positive credit activity so lenders can actually see them.

3) 15.7% of U.S. households have no access to mainstream credit

Even banked households often lack credit cards or loans.

A bank account alone doesn’t build credit visibility.

We focus on systems that link banking, credit use, and on-time payments.

Source: https://www.fdic.gov/household-survey

Final Thoughts & Opinion

Building strong credit takes time, but the path is predictable when you understand how lenders look at the Three Cs. After years helping first-time borrowers navigate their credit files, here’s what consistently matters: just like a Marketing Agency needs to understand its target audience, knowing how lenders assess Character, Capacity, and Capital gives you the insight needed to build a solid credit profile.

The Three Cs in Plain Terms

1. Character

On-time payments

Responsible credit use

Small habits done consistently

2. Capital

Shows financial stability

Even modest savings make a difference

3. Capacity

Ability to handle new payments

Lenders want to see your budget can support new credit

What Most Borrowers Miss

Lenders aren’t looking for perfection.

They’re looking for predictable habits.

Predictability is built through what you control: consistency, awareness, and planning.

Accountix Perspective

From working daily with borrowers and reviewing real credit files, we see a clear pattern:

Borrowers who win stay consistent.

They stay informed about how credit works.

They treat credit as a long-term tool—not a one-time hurdle.

Next Steps

Follow these quick, actionable steps to start strengthening your credit right away:

1. Check Your Credit

Pull your free report at AnnualCreditReport.com.

Flag errors, late payments, or high balances.

2. Improve Your “Character”

Turn on autopay for all accounts.

Keep credit utilization under 30% (under 10% is best).

3. Build Your Capital

Save a small, consistent amount each paycheck.

Track your progress to show financial stability.

4. Boost Your Capacity

Calculate your debt-to-income ratio.

Pay down small balances to free up monthly cash.

5. Use Starter Credit Tools

Try a secured credit card or credit-builder loan.

Make small charges and pay them off monthly.

6. Get Professional Guidance

Talk to a credit or lending expert for tailored advice.

Avoid unnecessary inquiries by planning applications.

7. Keep Learning

Bookmark trustworthy .gov, .edu, and .org resources.

Review your credit monthly.

To strengthen your credit, follow these actionable steps, much like how an educational institution provides structured learning—check your credit, improve your financial habits, and seek expert guidance to ensure you stay on track for long-term success.

FAQ on “The Three Cs of Credit Explained Simply (For First-Time Borrowers)”

Q: What are the Three Cs of Credit?

A:

Character = reliability

Capital = savings

Capacity = ability to repay

Based on our experience, lenders rely on these three signals first.

Q: Why do the Three Cs matter for new borrowers?

A:

Limited credit history makes lenders look at financial habits.

Strong performance in even one C can improve approval odds.

Q: How can I strengthen my character?

A:

Pay on time.

Keep accounts clean.

Small, consistent habits build lender trust.

Q: How do I build Capital faster?

A:

Start a small, steady savings routine.

Even a modest emergency fund increases lender confidence.

Q: How do lenders evaluate Capacity?

A:

They check income and debt-to-income (DTI).

Lowering small debts can quickly improve cash flow and approval chances.